MeetingMentor Magazine

Get the Inside Scoop on Meeting Venue Operations

Source: “Trends in the Meeting Venue Industry”

If you want to know how meeting venues sell, operate, and allocate revenue and costs for group business, who better to ask than the venues themselves? That’s what IACC (formerly International Association of Conference Centers) and the Society for Hospitality and Foodservice Management did when they collected 2018 operating data from 69 corporate, executive, resort and university conference centers in the U.S. The resulting report, “Trends in the Meeting Venue Industry,” provides an insider’s perspective that meeting organizers should find informative when looking to book a conference center for meeting space, guest rooms or both.

Meetings are growing longer. One interesting finding was a change in meeting lengths observed between 2017 and 2018. While 44 percent saw no change, an additional 44 percent said meeting lengths were increasing; only 12 percent said meetings were growing shorter.

Average daily rates vary by location. If you want to score a lower daily meeting package (DMP) rate, your best bet would be to choose a center in an airport location, where rates for meetings of groups belonging to the center’s owner average just $60 — $89 for meetings of external groups. City and rural/nonresort locations are next on the thrifty list, while suburban centers were priciest for both internal and external meetings.

Package rates vary by meeting type. Those DMP rates also are allocated slightly differently for internal versus external meetings. For example, meeting rooms account for 17 percent of the internal meeting package, while they comprise 35 percent for external meetings. Food and beverage (F&B) also takes a bigger bite out of the internal package rate at 31 percent, compared to 18 percent for external meeting package rates.

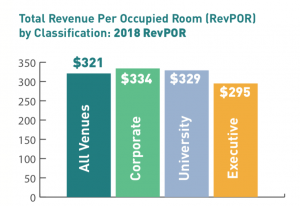

Total revenue per occupied room (RevPOR) doesn’t vary much among facility types. The 2018 RevPOR was $321 on average for all venue types, with corporate and university centers staying within $10 of that average and executive centers only slightly lower. Conference centers derive revenue from a number of sources: sleeping rooms (if it is a residential center), which usually is one piece of the complete meeting package; F&B; conference services; transportation; recreation, such as golf or spa; and income from concessions and retail space rentals.

Look for incentives to book in the off season. While venues that don’t market to external groups don’t feel the need to offer incentives for booking in low-demand periods, 100 percent of those who do market to outside groups do offer additional incentives. Almost three-quarters of respondents also said they have an “appropriate room size for group” policy to weed out the “space hogs” who want to monopolize the meeting space, and more than half said they charge a no-show penalty.

Who offers what? If you need a lot of double rooms, your best bet would be an executive or university center — about a quarter of each of those facilities offer doubles, compared to just 4 percent of corporate centers. While suites are not commonly offered by this market segment, 5 percent of executive centers and 2 percent of universities do have suites, while none of the corporate centers surveyed do. And if your group is big into dining together, executive and university centers also offer more seats per dining room than corporate centers.

Corporate centers do tend to have more meeting space, however: 22,785 square feet on average, compared to 20,203 for executive centers and 17,755 for universities. They also have more amphitheater spaces and more large-sized meeting rooms. In general, for residential centers, the number of meeting rooms rises with the number of sleeping rooms available.

For more details, check out the IACC & SHFM Infographic. The full report can be purchased here.

Free Subscription to

MeetingMentor Online

"*" indicates required fields

About ConferenceDirect

About MeetingMentor