Meeting Mentor Magazine

GBTA Report

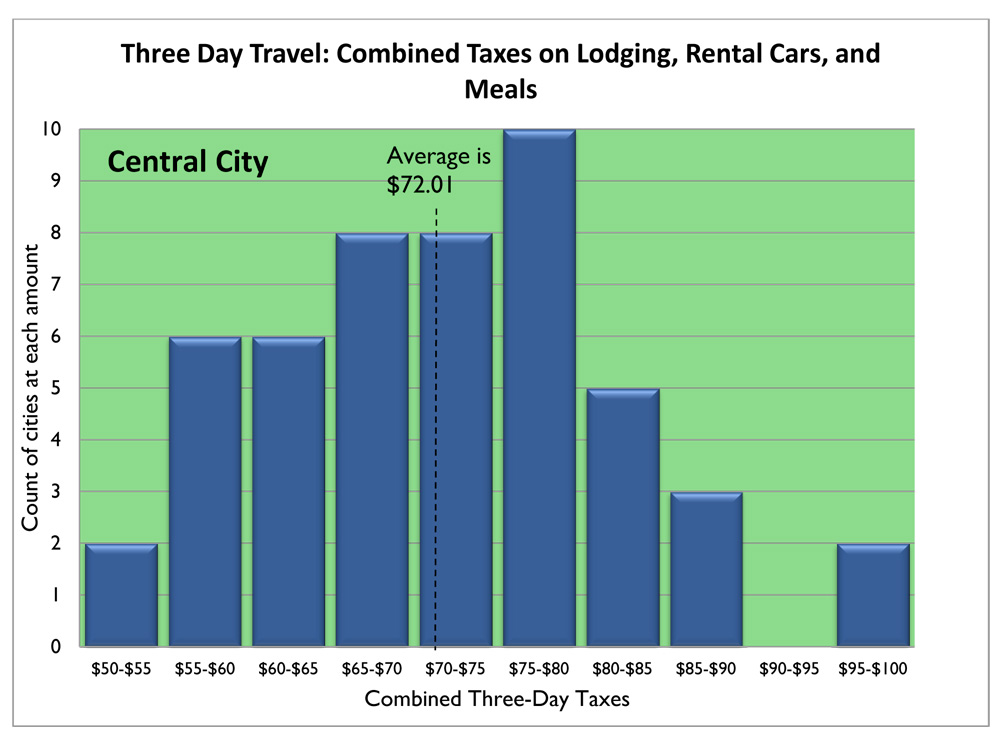

Center City Tax Burden Averages

$72.01 for Three-Day Travel

Not only do meeting professionals and corporate travel managers find it hard to stay on top of add-on travel fees, they’re finding it ever more challenging to budget for what the Global Business Travel Association calls the “complex system of travel taxes administered by state and municipal governments.”

That’s the tax burden GBTA focused on in its September research report on Travel Taxes in the U.S.: The Best and Worst Cities to Visit.

One piece of information in the report will be especially helpful to both corporate and association meeting professionals. Combined taxes on lodging, rental cars and meals in central cities for a three-day trip averaged $72.01, but ranged from a low of $50-$55 to a high of $95-$100.

Destinations with the lowest total tax burden (lodging, rental cars, meals) in their central cities in 2012 are:

Fort Lauderdale, FL

Fort Myers, FL

West Palm Beach, FL

Detroit, MI

Portland, OR

Orange County, CA

Burbank, CA

Ontario, CA

Honolulu, HI (new)

Orlando, FL (new)

Single-day travel taxes for the above cities ranged from $22.21 (Ft. Lauderdale) to $24.50 (Orlando).

Note: According to the report, taxes in Honolulu and Orlando are essentially unchanged from last year, but moved up in the rankings because previously low-tax cities saw some notable increases in 2012.

Destinations with the highest total tax burden (lodging, rental cars, meals) in their central cities in 2012 are:

Chicago, IL

New York, NY

Boston, MA

Kansas City, MO

Seattle, WA

Minneapolis, MN

Cleveland, OH

Indianapolis, IN

Nashville, TN

Houston, TX (new)

Single-day travel taxes for the above cities ranged from $40.31 (Chicago) to $33.51 (Houston).

Note: Similarly, Houston changed little in the ranking, just moving up from 11th place last year.

Meanwhile, U.S. cities are increasing their reliance on discriminatory travel taxes — such as excise taxes on hotels and car rentals, and sales taxes targeted at travelers. The top 5 cities in 2012 with the lowest discriminatory tax rates on lodging, rental cars and meals in center city locations are all in California: Burbank, Orange County, Ontario, San Diego and Los Angeles. The top 5 cities in 2012 with the highest discriminatory tax rates on lodging, rental cars and meals in center city locations are: Portland, OR; Boston, MA; Chicago, IL; New York, NY; and Minneapolis, MN. — Maxine Golding

Design by: Loewy Design