MeetingMentor Magazine

Could This Be the Beginning of the End of the U.S. Hotel Growth Streak?

Growth for U.S. hotels is projected to slow noticeably for 2019 and 2020, with revenue per available room (RevPAR) now being forecast to grow less than 1%. This downturn, from nine straight years of 3% or higher RevPAR increases, “clearly represents the industry’s worst years since the recession,” said Amanda Hite, president of hospitality industry data benchmarking, analytics and marketplace insights provider STR.

Growth for U.S. hotels is projected to slow noticeably for 2019 and 2020, with revenue per available room (RevPAR) now being forecast to grow less than 1%. This downturn, from nine straight years of 3% or higher RevPAR increases, “clearly represents the industry’s worst years since the recession,” said Amanda Hite, president of hospitality industry data benchmarking, analytics and marketplace insights provider STR.

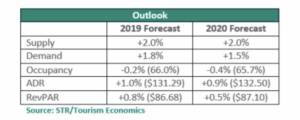

The projections, based on STR’s final forecast revision of 2019, produced in partnership with Tourism Economics, show RevPAR increases of 0.8% growth for 2019 and 0.5% growth for 2020. As of the last forecast released in August, STR was projecting a 1.6% increase for 2019 and a 1.1% increase for 2020.

With occupancy rates continuing to be flat, U.S. hotels are relying on the average daily rate (ADR) to drive RevPAR growth. ADR was projected to grow 1% in 2019. Supply was predicted to outpace demand this year, though not by much: a 2% increase in supply, compared to a 1.8% bump in demand.

Next year, STR predicts occupancy at U.S. hotels will drop 0.4%, while ADR rises 0.9%. Supply is again expected to outstrip demand, with projected growth rates of 2% and 1.5%, respectively.

“At the risk of sounding like a broken record, the major factor in our revisions continues to be a lack of pricing confidence,” Hite said. “Supply growth is coming in ahead of demand growth a bit sooner than expected, so occupancy levels are slightly lower than projected. The major difference is with ADR, where we downgraded by 80 basis points for 2019 and 60 basis points for 2020. ADR has grown below the level of inflation for five consecutive quarters.

“Fortunately, demand is going to continue to grow beyond the record levels the industry has already achieved. Domestic travel continues to increase with forward-looking domestic air bookings remaining strong.” While STR is still predicting a strong domestic vacation market, the outlook for overseas travelers is more of a mixed bag, she added, which could negatively affect demand.

Up and Down Markets

More than half of the top 25 markets are forecast to see a RevPAR decrease this year, with the steepest declines projected for Seattle and New York City. In aggregate, the top 25 markets underperformed the rest of the country in RevPAR growth 11 out of the last 12 months, according to STR. While New York is projected to record another steep decline next year, 19 of the top 25 markets are projected to see a RevPAR increase next year, with Miami/Hialeah, Fla., leading the pack.

For 2019, the markets seeing the biggest RevPAR growth, 3% or higher, were Atlanta; Denver; Phoenix; and San Francisco/San Mateo, Calif.

STR also broke its projections down by chain scale segments. Economy and independent hotels were expected to be the only segments to see occupancy increases, and those would be small — 0.4% and 0.3%, respectively. Luxury chains are expected to experience the largest ADR growth at 1.9%, while independents likely will see the biggest uptick in RevPAR, 1.8%. The steepest RevPAR declines are predicted for upscale (-0.4%) and midscale (-0.4%) properties.

Free Subscription to

MeetingMentor Online

"*" indicates required fields

About ConferenceDirect

About MeetingMentor